Not known Facts About Tulsa Bankruptcy Lawyer

Table of Contents10 Easy Facts About Bankruptcy Law Firm Tulsa Ok DescribedA Biased View of Bankruptcy Lawyer TulsaSee This Report on Tulsa Ok Bankruptcy AttorneyNot known Facts About Tulsa Ok Bankruptcy AttorneyChapter 7 Bankruptcy Attorney Tulsa - An Overview

The stats for the other main type, Chapter 13, are also worse for pro se filers. Suffice it to claim, speak with a legal representative or two near you that's experienced with personal bankruptcy regulation.Many attorneys additionally supply totally free appointments or email Q&A s. Capitalize on that. (The charitable app Upsolve can aid you discover complimentary examinations, resources and lawful aid at no cost.) Ask them if insolvency is indeed the ideal choice for your situation and whether they assume you'll certify. Before you pay to submit insolvency types and imperfection your credit history record for up to one decade, examine to see if you have any type of viable choices like financial obligation arrangement or charitable credit scores therapy.

Advertisement Now that you've decided insolvency is undoubtedly the best program of action and you ideally removed it with an attorney you'll require to get begun on the documentation. Prior to you dive into all the official bankruptcy types, you ought to obtain your very own files in order.

Some Of Bankruptcy Attorney Near Me Tulsa

Later down the line, you'll really need to prove that by divulging all type of details about your economic events. Right here's a basic checklist of what you'll require when driving ahead: Recognizing files like your vehicle driver's permit and Social Safety card Tax returns (as much as the past 4 years) Proof of revenue (pay stubs, W-2s, independent profits, income from possessions in addition to any earnings from federal government benefits) Bank statements and/or pension declarations Evidence of value of your assets, such as lorry and property valuation.

You'll intend to recognize what kind of financial debt you're trying to fix. Financial obligations like kid support, spousal support and specific tax financial obligations can not be released (and personal bankruptcy can not halt wage garnishment pertaining to those financial obligations). Trainee funding debt, on the various other hand, is possible to discharge, however note that it is hard to do so (Tulsa OK bankruptcy attorney).

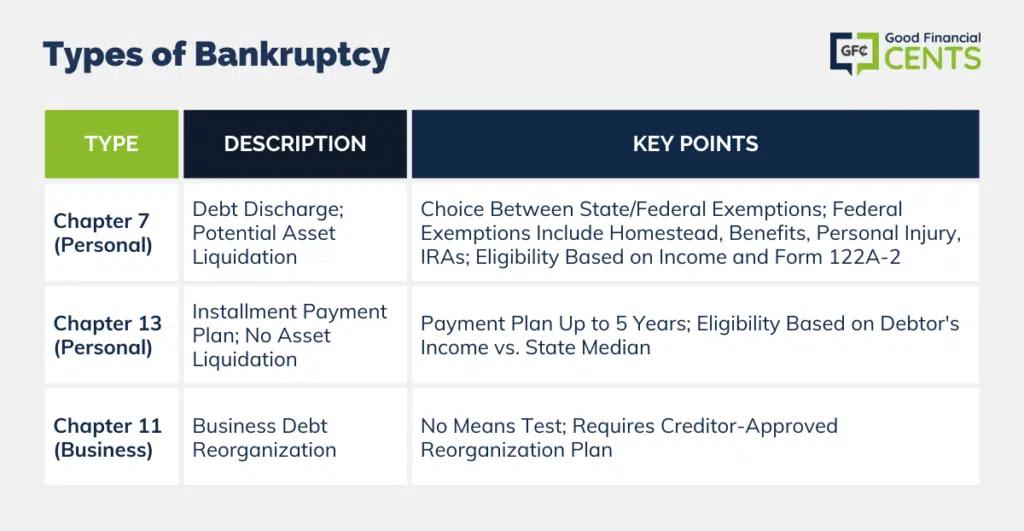

You'll intend to recognize what kind of financial debt you're trying to fix. Financial obligations like kid support, spousal support and specific tax financial obligations can not be released (and personal bankruptcy can not halt wage garnishment pertaining to those financial obligations). Trainee funding debt, on the various other hand, is possible to discharge, however note that it is hard to do so (Tulsa OK bankruptcy attorney).If your income is as well high, you have one more alternative: Phase 13. This alternative takes longer to solve your financial debts since it needs a long-lasting settlement strategy typically three to five years prior to a few of your remaining financial obligations are wiped away. The filing procedure is likewise a whole lot extra complex than Phase 7.

3 Simple Techniques For Bankruptcy Law Firm Tulsa Ok

A Chapter 7 bankruptcy stays on your credit record for 10 years, whereas a Chapter 13 personal bankruptcy drops off after 7. Before you send your insolvency forms, you have to first finish a compulsory course from a credit therapy firm that has actually been approved by the Division of Justice (with the significant exemption of filers in Alabama or North Carolina).

The course can be finished online, in person or over the phone. You need to finish the program within 180 days of declaring for bankruptcy.

See This Report on Experienced Bankruptcy Lawyer Tulsa

Examine that you're submitting with the proper one based on where you live. If your long-term house has actually relocated within 180 days of filling up, you must file in the district where you lived the greater section of that 180-day duration.

Usually, your personal bankruptcy attorney will deal with the trustee, but you might require to send out the individual documents such as pay stubs, income tax return, and savings account and bank card declarations directly. The trustee that was just appointed to your instance will quickly establish a mandatory conference with you, called the "341 meeting" since it's a requirement of Area 341 of the U.S

:max_bytes(150000):strip_icc()/what-is-chapter-7-bankruptcy-316202color-355f125a28264491a0cac1313e2c914b.jpg) You will certainly need to give a prompt listing of what certifies as an exception. Exceptions might apply to non-luxury, main automobiles; required home goods; and home equity (though these exemptions rules can differ widely by state). Any residential property outside the checklist of exceptions is taken into consideration nonexempt, and if you don't provide any kind of list, after that important source all your residential property is thought about nonexempt, i.e.

You will certainly need to give a prompt listing of what certifies as an exception. Exceptions might apply to non-luxury, main automobiles; required home goods; and home equity (though these exemptions rules can differ widely by state). Any residential property outside the checklist of exceptions is taken into consideration nonexempt, and if you don't provide any kind of list, after that important source all your residential property is thought about nonexempt, i.e.The trustee wouldn't market your sporting activities car to instantly pay off the lender. Rather, you would certainly pay your creditors that amount throughout your layaway plan. A common misconception with personal bankruptcy is that once you file, you can quit paying your financial debts. While bankruptcy can aid you erase much of your unprotected debts, such as overdue medical costs or personal fundings, you'll wish to maintain paying your month-to-month payments for secured debts if you wish to keep the residential or commercial property.

Fascination About Bankruptcy Attorney Tulsa

If you're at threat of foreclosure and have actually tired all various other financial-relief choices, after that filing for Chapter bankruptcy lawyer Tulsa 13 might delay the foreclosure and assist in saving your home. Eventually, you will still need the earnings to continue making future home mortgage repayments, along with paying off any kind of late payments throughout your layaway plan.

If so, you might be called for to give additional info. The audit can delay any financial debt relief by several weeks. Certainly, if the audit transforms up incorrect information, your situation could be rejected. All that claimed, these are fairly unusual circumstances. That you made it this far in the procedure is a decent indication a minimum of several of your financial debts are eligible for discharge.